Introduction

The Internal Rate of Return (IRR) is one of the most relevant metrics for evaluating the performance of private equity investments. Since these investments are typically characterized by irregular cash flows, long time horizons, and complex structures, accurately calculating IRR is essential for analysts, fund managers, institutional investors, and advanced finance students.

This article explains how to calculate IRR in private equity, its distinguishing features compared to other types of investments, the most commonly used calculation methods, and practical examples to facilitate understanding.

What Is IRR in Private Equity

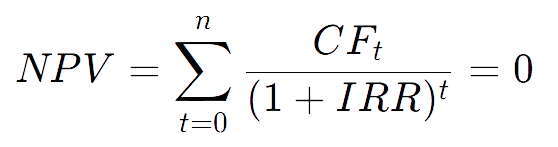

The Internal Rate of Return (IRR) represents the discount rate that sets the Net Present Value (NPV) of all investment cash flows equal to zero.

Mathematically:

Where:

-

CFₜ: Cash flow in period t

-

t: Time period

-

IRR: Internal Rate of Return

-

n: Total number of periods

In private equity, IRR measures the annualized return generated by an investment, taking into account capital contributions, distributions, and the final exit value.

Distinctive Characteristics of IRR in Private Equity

Unlike liquid assets such as stocks or bonds, private equity investments have characteristics that influence IRR calculation:

1. Non-periodic Cash Flows

Investors make capital calls at different times and receive irregular distributions.

2. Long Investment Horizon

Private equity funds typically have life cycles ranging from 7 to 12 years.

3. Timing Impact

IRR is highly sensitive to the timing of cash inflows and outflows.

4. Presence of Residual Value

There is often an estimated investment value at the end of the analyzed period.

Methods to Calculate IRR in Private Equity

Method 1:

Iterative Mathematical Calculation

IRR cannot be directly isolated from the NPV equation. Therefore, it is calculated through iterative processes that identify the rate at which NPV equals zero.

This method is typically implemented using financial software or programming.

Method 2:

Using Excel or Financial Software

In professional practice, IRR in private equity is mainly calculated using:

-

IRR() function → For periodic cash flows

-

XIRR() function → For irregular cash flows (most common in private equity)

Practical Example 1:

Basic IRR Calculation in Private Equity

Assumptions

An investor participates in a private equity fund with the following cash flows:

| Year | Cash Flow (€) |

|---|---|

| 0 | -1,000,000 |

| 1 | -500,000 |

| 3 | 400,000 |

| 5 | 900,000 |

| 7 | 1,200,000 |

Negative values represent capital contributions, while positive values represent distributions.

Step 1: Organize Cash Flows

Cash flows are recorded along with their corresponding dates.

Step 2: Apply the XIRR Formula in Excel

Syntax:

=XIRR(cash_flows, dates)

If the above flows are entered correctly, the approximate result would be:

IRR ≈ 17.2% annually

Interpretation

The investment generates a compounded annual return of 17.2%, considering the actual cash flow schedule.

Practical Example 2:

IRR with Residual Value

In private equity, investments are often evaluated before full liquidation.

Assumptions

| Year | Cash Flow (€) |

|---|---|

| 0 | -2,000,000 |

| 2 | -500,000 |

| 4 | 600,000 |

| 6 | 800,000 |

| 6 | Residual Value: 2,200,000 |

Step 1:

Include Residual Value

The residual value is added to the final period’s cash flow.

Total cash flow in Year 6:

800,000 + 2,200,000 = 3,000,000

Step 2:

Calculate IRR

Applying XIRR:

IRR ≈ 15.6% annually

Common Mistakes When Calculating IRR in Private Equity

1. Ignoring Irregular Cash Flows

Using standard IRR instead of XIRR can produce inaccurate results.

2. Excluding Residual Value

This can significantly underestimate performance.

3. Interpreting IRR Without Considering Risk

Two investments with identical IRRs may have completely different risk profiles.

4. Multiple IRR Problems

When cash flows change sign multiple times, several mathematical solutions may exist.

Complementary Metrics to IRR

In professional private equity analysis, IRR is usually accompanied by additional indicators:

MOIC (Multiple on Invested Capital)

Measures how many times the invested capital is recovered.

DPI (Distributed to Paid-In)

Indicates the capital effectively returned to the investor.

TVPI (Total Value to Paid-In)

Includes both distributed value and residual value.

Advantages and Limitations of IRR in Private Equity

Advantages

-

Enables comparison of investments with different time horizons

-

Accounts for the time value of money

-

Widely accepted within the industry

Limitations

-

Sensitive to the timing of cash flows

-

May lead to misleading decisions if analyzed in isolation

-

Assumes reinvestment of cash flows at the same rate

Best Practices for Calculating IRR in Private Equity

-

Always use cash flows with exact dates

-

Complement IRR with additional performance metrics

-

Perform sensitivity analysis

-

Validate consistency across alternative scenarios

-

Adjust for risk and sector benchmarking

Conclusion

Calculating IRR in private equity is a fundamental process for evaluating the actual profitability of investments with complex structures and irregular cash flows. Although the theoretical formula is relatively simple, its practical application requires appropriate tools, a clear understanding of the temporal behavior of cash flows, and complementary analysis.

Proper use of functions such as XIRR, inclusion of residual value, and joint interpretation with metrics such as MOIC and TVPI provide a comprehensive view of private equity investment performance.

For analysts and investors, mastering IRR calculation not only improves financial evaluation but also strengthens strategic decision-making in markets where analytical precision is critical.